13 Lending Institution Myths Debunked

When it concerns personal money, one frequently deals with a wide range of alternatives for banking and monetary services. One such alternative is lending institution, which provide a various technique to traditional banking. Nevertheless, there are several myths surrounding cooperative credit union membership that can lead people to ignore the advantages they provide. In this blog, we will certainly disprove common misconceptions about cooperative credit union and clarified the advantages of being a cooperative credit union participant.

Misconception 1: Limited Ease of access

Fact: Convenient Gain Access To Anywhere, At Any Time

One usual myth concerning lending institution is that they have actually restricted accessibility compared to traditional banks. However, credit unions have actually adjusted to the modern-day age by offering online banking solutions, mobile applications, and shared branch networks. This permits participants to easily handle their financial resources, access accounts, and conduct transactions from anywhere at any time.

Myth 2: Subscription Limitations

Fact: Inclusive Membership Opportunities

Another common misunderstanding is that lending institution have limiting subscription requirements. Nonetheless, lending institution have expanded their eligibility requirements for many years, allowing a more comprehensive series of individuals to sign up with. While some cooperative credit union might have certain associations or community-based demands, many credit unions supply inclusive subscription chances for anybody that lives in a certain area or operates in a specific market.

Myth 3: Minimal Item Offerings

Fact: Comprehensive Financial Solutions

One misunderstanding is that lending institution have limited item offerings compared to standard financial institutions. Nevertheless, lending institution give a wide variety of economic options designed to satisfy their members' needs. From fundamental monitoring and interest-bearing account to finances, home mortgages, credit cards, and financial investment choices, cooperative credit union strive to use thorough and affordable products with member-centric benefits.

Misconception 4: Inferior Technology and Advancement

Truth: Welcoming Technical Innovations

There is a myth that cooperative credit union hang back in regards to innovation and technology. Nevertheless, lots of credit unions have actually purchased sophisticated innovations to improve their members' experience. They offer robust online and mobile financial systems, protected digital payment alternatives, and cutting-edge economic devices that make handling financial resources simpler and more convenient for their participants.

Myth 5: Lack of Atm Machine Networks

Truth: Surcharge-Free ATM Accessibility

One more mistaken belief is that cooperative credit union have restricted atm machine networks, resulting in charges for accessing money. Nonetheless, cooperative credit union usually join across the country ATM networks, offering their participants with surcharge-free access to a vast network of Atm machines across the country. Furthermore, many credit unions have collaborations with various other lending institution, enabling their participants to make use of shared branches and perform deals easily.

Misconception 6: Lower Top Quality of Service

Fact: Individualized Member-Centric Service

There is an understanding that cooperative credit union offer reduced quality solution compared to conventional banks. Nevertheless, lending institution prioritize customized and member-centric service. As not-for-profit establishments, their key focus gets on serving the most effective interests of their members. They aim to construct strong relationships, offer tailored monetary education and learning, and offer affordable interest rates, all while ensuring their members' monetary wellness.

Misconception 7: Limited Financial Stability

Truth: Strong and Secure Financial Institutions

Unlike popular belief, lending institution are financially stable and safe and secure establishments. They are managed by government companies and comply with rigorous standards to make sure the security of their members' deposits. Credit unions also have a participating framework, where members have a say in decision-making processes, aiding to keep their stability and safeguard their members' passions.

Myth 8: Lack of Financial Services for Businesses

Fact: Company Banking Solutions

One usual myth is that credit unions just deal with private consumers and do not have comprehensive economic services for organizations. Nevertheless, numerous credit unions use a range of organization financial remedies tailored to fulfill the distinct needs and demands of small businesses and business owners. These solutions may consist of company examining accounts, company lendings, seller services, payroll handling, and company bank card.

Myth 9: Restricted Branch Network

Fact: Shared Branching Networks

An additional misunderstanding is that lending institution have a limited physical branch network, making it tough for participants to access in-person services. Nevertheless, lending institution usually participate in shared branching networks, enabling their participants to perform transactions at other cooperative credit union within the network. This common branching version dramatically expands the number of physical branch locations offered to lending institution participants, providing them with greater benefit and availability.

Misconception 10: Higher Rate Of Interest on Financings

Fact: Affordable Loan Prices

There is an idea that credit unions bill greater rates of interest on financings contrasted to typical financial institutions. As a matter of fact, these institutions are known for offering affordable prices on financings, consisting of automobile fundings, individual fundings, and home loans. As a result of their not-for-profit status and member-focused technique, cooperative credit union can often give a lot more beneficial rates and terms, inevitably benefiting their participants' monetary well-being.

Misconception 11: Limited Online and Mobile Banking Qualities

Truth: Robust Digital Financial Solutions

Some individuals think that credit unions supply restricted online and mobile info financial functions, making it testing to handle funds digitally. But, cooperative credit union have actually invested dramatically in their digital financial systems, offering participants with robust online and mobile financial services. These systems often consist of attributes such as bill repayment, mobile check down payment, account notifies, budgeting tools, and secure messaging abilities.

Myth 12: Absence of Financial Education And Learning Resources

Reality: Focus on Financial Proficiency

Several credit unions position a strong focus on financial literacy and offer different instructional sources to help their members make notified monetary choices. These sources might consist of workshops, workshops, money tips, short articles, and customized economic therapy, encouraging participants to boost their economic health.

Misconception 13: Limited Financial Investment Options

Fact: Diverse Financial Investment Opportunities

Credit unions frequently offer participants with a series of financial investment possibilities, such as individual retirement accounts (Individual retirement accounts), deposit slips (CDs), mutual funds, and also access to monetary experts who can provide support on lasting financial investment techniques.

A New Age of Financial Empowerment: Getting A Credit Union Subscription

By disproving these lending institution misconceptions, one can get a better understanding of the advantages of lending institution subscription. Cooperative credit union offer hassle-free access, inclusive subscription possibilities, extensive financial remedies, accept technological innovations, give surcharge-free ATM accessibility, focus on customized solution, and maintain solid monetary security. Get in touch with a credit union to keep learning about the advantages of a membership and exactly how it can lead to a much more member-centric and community-oriented banking experience.

Learn more about banks in Windsor today.

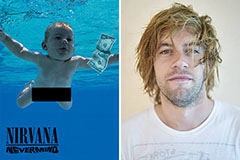

Spencer Elden Then & Now!

Spencer Elden Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Michelle Trachtenberg Then & Now!

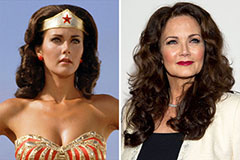

Michelle Trachtenberg Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!